So, consider this passive income idea if you’re up-to-date on various markets and industry movements. Although the stock market might have a steep learning curve and can be confusing, it’s a great way to build lasting wealth. A common mistake most people how to create multiple sources of income in india make with investment funds is thinking short term instead of playing the long game to reach financial goals. However, if you’re a full-time photographer or own a good camera, you can generate passive income from photography by selling photos online.

You don’t have to work for this continuous flow of money. It is the more beneficial characteristic of passive income sources. Hence you should invest in some of the passive income ideas mentioned above. You can start video blogging and posting pictures on your handle. You can earn by advertising different products and engagements. Influencers are the new mode of advertising and product promotion.

A Tailoring Or Boutique Business:

Though it has a lower interest rate than fixed deposits, they’re more liquid.You can also invest money in Mutual Funds or SIPs. There are many alternate sources of passive income in India. You can select one or more than one as per your choice and specifications. The passive income is generally based on the work-from-home concept. Given below some of the ways to generate passive income in India. Monetizing options include Google Adsense or affiliate marketing.

What are the 7 sources of income in India?

- Salary Income. You already know what a salary is but, let's define it anyway!

- Interest Income.

- Dividend Income.

- Capital Gains Income.

- Rental Income.

- Profit Income.

- Royalty Income.

A potential side benefit of this approach is that you may hold the property so long that the tax bill on capital gains is dramatically reduced. Alternatively, you could buy houses from struggling fix-and-flip professionals to serve as rental properties. The odds you’ll get a bargain to go up the longer the housing market is in the doldrums. There are many ways to make passive income in real estate. Many people get involved in house flipping to make more money because it seems straightforward. Buy a run-down house, make repairs, fix it up, and sell it for a profit.

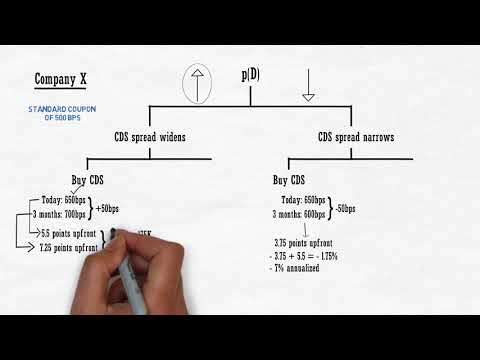

Investing in Stocks and Mutual Funds

We request you to be vigilant before sharing your personal and financial information with any third party. Beware of fraudulent activities claiming affiliation with our company and promising monetary rewards or benefits. Chegg India shall not be responsible for any losses resulting from such activities. If you accept and perform unauthorized work while on an H1B visa, you would be violating your visa status.

- Investing in REITs is one of the best passive income ideas for investors.

- You can sell online courses repeatedly without holding any inventory or stock, generating passive income.

- Play AAA Rated games like Carrom, Ludo, Call Break & more against each other in skill-games and win real money.

- You own a flat or car; you rent it out to someone to earn money.

- There are many options such as website design, content marketing, SEO, social media marketing and technical support.

Passive income is subject to taxation, though it’s taxed differently than your regular income. In India, 62% Gen Zs and 51% Indian millennials have side jobs or passive income, according to the Deloitte Global 2022 Gen Z and Millennial Survey. It also carries liquidity issues and a significant upkeep cost. Moreover, the quality of your investment depends on the desirability of the property in terms of location. But the secret lies in selecting the right companies with a strong business model and balance sheet.

Real Estate Crowdfunding

Design websites like 99designs, ThemeForest, or Creative Market are great places to generate a passive income stream by selling digital designs online. This idea for a side income is good for people who know enough about trading and the share market to put some money into it. You can also learn about the stock market and start trading there. To begin trading on the stock market, you must create an online Demat account. This side income source can be a good way to make money from home if you can wisely invest your money in the right shares, mutual funds, and derivatives. However, you should always consider the risk related to the share market and make decisions as per your income and risk-taking capability.

- Unlike many of the other passive income ideas on this list, photography is a service-based business, which typically means you get paid for your time.

- We are not suggesting using crowdfunding instead of applying for a mortgage.

- Below, we have identified key passive income strategies you can use to build financial security.

- ETFs invest in a mix of stocks, commodities and bonds but have a lower risk compared to stocks.

- You can use your skills such as writing, selling, advertising, etc. online to generate passive income with no initial funds or investment.

- International funds have been known to generate returns of 14-20%.

Some high-yield savings accounts and certificates of deposits offer over 4% APY. As a long-term investment, real estate investment trusts are one of the best income ideas to look into if you have startup capital. Besides upfront capital, getting started also takes some in-depth research. Thankfully, there are plenty of resources, like this guide, to help you get started.

passive income ideas to help you make money in 2023

Additionally, there is no option to reinvest in a non-cumulative deposit. Additionally, a pandemic like Covid-19 has accentuated the need to have a passive income. Let’s dig deep into the concept of passive income, and how you you generate one. The passive income you earn is taxable in India under Section 80C, Section 24 and Section 80CCD1. Check the table mentioned in the article to get the full picture.

What are the 8 types of income?

- Earned income. The most basic form of income stream – it's the income that we get in exchange for our time and effort like the salary from our jobs.

- Profit.

- Interest income.

- Dividend income.

- Rental income.

- Capital gains.

- Royalty income.

- Residual income.