You can’t just tuck your clients’ settlement funds in with the rest of your law firm’s general funds, and you certainly can’t stuff those crisp dollar bills in a pillowcase for safekeeping. To establish trust with your clients and ensure your law firm upholds its ethical responsibilities, you need to learn some accounting principles. Company A is involved in a lawsuit, and after consulting with legal counsel, they determine that it is probable they will lose the case. It is important for businesses to consult with tax professionals to determine the appropriate tax treatment of a settlement.

GAAP Accounting for Lawsuit Proceeds and Settlements

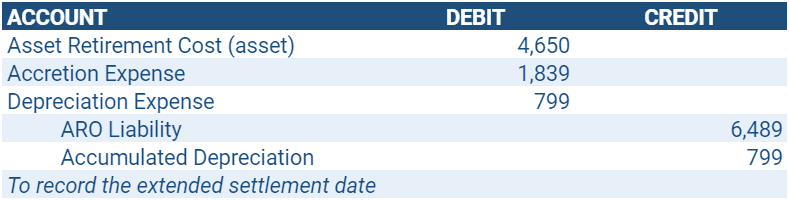

The amount is fixed at the time that a better estimation (or final figure) is available. This same reporting is utilized in correcting any reasonable estimation. Wysocki corrects the balances through the following journal entry that removes the liability and records the remainder of the loss. I also said consult with his own tax CPA to determine if the applicable law allows this award to be booked over time. And to comply with both possibilities (by simply toggling between cash and accrual reporting depending on who wants to see what) I see an Invoice for the award as the solution to the cash income spread over 10 + years. Under PURE Cash rules one can not invoice anyone or enter bills for future payment so we use, as allowed by IRS, hybrid cash or whatever it is called.

3: Define and Apply Accounting Treatment for Contingent Liabilities

Both represent possible losses and both depend on some uncertain future event. To get the remaining 100k onto the balance sheet create a customer credit memo (same name as the payee) for 100k posted to an Other Asset account. Now going forward issue an Invoice as often as scheduled payments are posted as a reduction of the asset.

How to Keep Track of Self Employment Income

To simplify our example, we concentrate strictly on the journal entries for the warranty expense recognition and the application of the warranty repair pool. If the company sells 500 goals in 2019 and 5% need to be repaired, then 25 goals will be repaired at an average cost of $200. The average cost of $200 × 25 goals gives an anticipated future repair cost of $5,000 for 2019. Assume for the sake of our example that in 2020 Sierra Sports made repairs that cost $2,800. Following are the necessary journal entries to record the expense in 2019 and the repairs in 2020. The resources used in the warranty repair work could have included several options, such as parts and labor, but to keep it simple we allocated all of the expenses to repair parts inventory.

Rules to Record Contingent Liabilities as per IFRS

- But if the funds have already been earned, they should go into the firm’s operating account.

- There are two main reasons that lawyers should keep their clients’ funds separate from their personal or business operating accounts and from other fiduciary accounts.

- For example, if a piece of equipment is damaged and the insurance proceeds fully cover the loss, the recovery and the loss are reported in a manner that reflects the company’s financial position as if the loss had not occurred.

Settlement checks are the client’s property and should be deposited in a client’s trust account or an IOLTA account—never in the firm’s operating account. Before depositing the check, make sure the client and the firm both sign the check if the check is made out to both parties. Record the client number, matter number, and matter description on the check.

Say, for example, that your client sends a check to cover both legal fees and costs. You’re being paid a flat fee for services, and the costs will cover the court fees when you file the client’s personal injury lawsuit. It may be tempting to deposit all of the fees in your operating account, because the bulk of the check is covering your fees, and write a check from one account to the other.

This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Allocate the transaction price to the performance obligations in the contract; and,5. Recognize revenue when (or as) the entity satisfies a performance obligation. Again, I recommend working with your own CPA on this, before you make a bit of a mess in the accounting for something you want to Document, that is not Actual, at this time. We are getting a little out of sync on the conversation but to your point about proving the debt both my lawyer and I have signed copies of the filed settlement agreement so I can’t imagine that would be an issue.

This does not meet the likelihood requirement, and the possibility of actualization is minimal. In this situation, no journal entry or note disclosure in financial statements journal entry for lawsuit settlement is necessary. GAAP accounting rules require that probable contingent liabilities that can be estimated and are likely to occur be recorded in financial statements.

The company can make contingent liability journal entry by debiting the expense account and crediting the contingent liability account. The Supreme Court has concluded that a recovering plaintiff must include in gross income the portion of the recovery payable to the attorney as a contingent fee. The same rule would apply to attorney fees arising from settlement payments. Therefore, if an individual receives a settlement or award payment that is includible in income, any amounts allocated to attorney fees are also includible in the individual’s income. This is the case even if the defendant pays the legal fees directly to the attorney.