Content

A business that’s growing quickly can reasonably be expected to increase its income level over the short term, and so improve its debt-paying ability at the same time. When the DSCR real estate calculation shows a ratio of 2.0 or higher, the company is in a stronger financial position and could likely safely take on more debt. So it means that they have enough operating profit to service their current debt and will not face many difficulties to get another loan. However, while calculating DSCR, also take into account any debt and lease repayments due within the next 12 months in the denominator. The larger the DSCR ratio is, the more net operating income there is available to service the debt. To bring down net operating expenses, businesses can try to negotiate lower prices and better terms on things like raw materials or shipping or by changing vendors entirely. Keep in mind that the DSCR calculation is good for both the lender and the business applying for the loan.

Different industries have different risk profiles, and thus different DSCRs. A higher DSC ratio is better than a lower one, with a typical minimum requirement of 1.25x.

Debt Service Coverage Ratio & Financial Analysis

For example, if a property has a debt coverage ratio of less than one, the income that property generates is not enough to cover the mortgage payments and the property’s operating expenses. A property with a debt coverage ratio https://www.bookstime.com/ of .8 only generates enough income to pay for 80 percent of the yearly debt payments. However, if a property has a debt coverage ratio of more than 1, the property does generate enough income to cover annual debt payments.

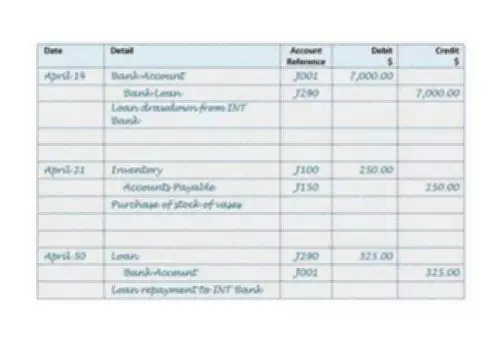

Total debt service refers to current debt obligations, meaning any interest, principal, sinking fund, and lease payments that are due in the coming year. On a balance sheet, this will include short-term debt and the current portion of long-term debt.

Debt Service Coverage Ratio

Loan principal due within the measurement period (often expressed as the current portion of long-term debt or CPLTD). Management may use DSCR calculations from its dscr formula competitors to analyze how it is performing relative to others, including analyzing how efficient other companies may be in using loans to drive company growth.

- In a nutshell, lenders have greater control over this ratio because they are the ones who will dictate the repayment of principal.

- Sometimes there will be variation in how the debt service coverage ratio is calculated.

- A higher DSC ratio is better than a lower one, with a typical minimum requirement of 1.25x.

- In contrast, if an entity has a DSCR of 1, then its income is equal to its monthly debt obligations, while if it has a DSCR of more than 1, its income is greater than its monthly debts.

- For example, your business currently has a loan for $250,000 for the building that you occupy.

- The rule of thumb is that when an entity is shown to have a DSCR of less than 1, then that means that its income is less than its monthly debt obligations.

- The DSCR is 1.0 if a company has an annual net operating income equal to the required annual payments of interest and principal on all debt.