The terms debit and credit signify actual accounting functions, both of which cause increases and decreases in accounts, depending on the type of account. That’s why simply using “increase” and “decrease” to signify changes to accounts wouldn’t work. Many retailers offer the option to add a cash amount for withdrawal to your purchase at the point of sale when you use a debit card.

The good news is that many banks don’t hold a consumer responsible for unauthorized transactions if he or she notifies the institution in a timely fashion. But remember that with a debit card, the money tapped by the thief has already been taken out of your account. Sal purchases a $1,000 piece of equipment, paying half of the purchase price immediately and signing a promissory note for the remaining balance. Sal’s journal entry would debit the Fixed Asset account for $1,000, credit the Cash account for $500, and credit Notes Payable for $500.

The Winner Is Debit!

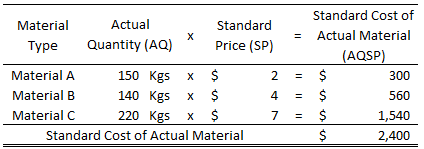

Each of the following accounts is either an Asset (A), Contra Account (CA), Liability (L), Shareholders’ Equity (SE), Revenue (Rev), Expense (Exp) or Dividend (Div) account.

The direct connection to your bank account is also what allows you to withdraw funds with your purchase. If a credit card will tempt you to take on a mountain of debt, stick with a debit card. If you don’t do that, you’ll find ways to spend more than you should, regardless of what’s in your wallet. However, one of the cons of debit cards is that they make spending slightly less convenient for the consumer. Unlike with a credit card, you can’t simply swipe a debit card; you also have to enter a personal identification number (PIN) to prevent others from stealing your card and misusing it. If you’re ready to explore your credit card options, you could start by comparing credit cards from Capital One.

When you want to save money on interest

A debit card is linked to your checking account and allows you to use the account for purchases. Debit cards can also be used at ATMs for cash withdrawals and other transactions. If you want the best of both worlds — the security of credit and the cost-effectiveness of debit — you might want to consider using your credit card like a debit card. If you’re going to charge a purchase to your credit card, make sure you can pay it off with the money that’s already in your checking account.

For everyday purchases, consider using your debit card because you will see the money taken out of your checking account right away. For bigger items, such as a rental car or hotel room, you could use your credit card so that you can save up money by the time you have to pay. “There are advantages and disadvantages to using both debit cards and credit cards.” Since a debit card is linked directly to a bank account, fraudulent purchases can quickly drain an account dry or lead to an overdraft. This cannot occur with credit cards since those are paid back at a later date.

They Prevent Debt, but Funds Run Out

“Be sure to repay more than the minimum on your credit card payments to avoid unnecessary interest,” says McCluney. These can be emergency expenses while you’re traveling, such as a flat tire, or other repairs and purchases. “Treat your debit card like cash,” says Jamilah N. McCluney, financial advisor and strategist at Black Wealth Financial.

A debit card is better for cash withdrawals and helps to avoid overspending and debt. For cash withdrawals at ATMs, your debit card is the best option. You’ll keep fees at a minimum, and your card information is unlikely to get stolen if you stick to safe ATMs. But one of the cons of debit cards is that if you make a large purchase, you’re forced to spend immediately, as the funds immediately get taken out of the account. Credit card expenditures are loans, so you don’t have to pay back what you borrowed right away.

Consider opening a credit card if you want to build credit

With a credit card, you have time between when you make the purchase and when your payment is due. That gives you more time to notice errors and dispute them while keeping your checking account intact. When you (or thieves with your card and PIN) use a debit card, the money immediately comes out of your checking account. According to findings from the Federal Reserve Bank of San Francisco’s Diary of Consumer Payment Choice, consumers used debit cards for 28% of payments and credit cards for 27% of payments in 2020. It can often be complicated to decide when it is best to use each card.

Dutch businesses will soon be able to use iPhones to accept debit … – NL Times

Dutch businesses will soon be able to use iPhones to accept debit ….

Posted: Tue, 22 Aug 2023 10:37:00 GMT [source]

Every transaction that occurs in a business can be recorded as a credit in one account and debit in another. Whether a debit reflects an increase or a decrease, and whether a credit reflects a decrease or an increase, depends on the type of account. There are a few theories on the origin of the abbreviations used for debit (DR) and credit (CR) in accounting.

Using a credit card calculator can help you understand just how long it might take to pay off a purchase depending on your budget and your card’s interest rate. Learn more about credit card advantages and disadvantages below. Accounts payable is a type of liability account, showing money which has not yet been paid to creditors. An invoice which has not been paid will increase accounts payable as a debit. When a company pays a creditor from accounts payable, it is a credit. Debit and credit cards are both used to pay for goods or services without paying in cash or writing a check.

- Here are a few choices that are particularly well suited for smaller businesses.

- When you use one, the card issuer pays the recipient on your behalf, and you later repay the card issuer.

- An increase in the value of assets is a debit to the account, and a decrease is a credit.

- With these smaller purchases, you can easily track your spending and ensure that you have enough money in your checking account to cover the transactions.

While they may look the same and feature similar features like 16-digit card numbers, expiration dates, and branded Visa or MasterCard logos, credit cards and debit cards differ in important ways. The key difference is that debit cards are linked to a bank account and draw directly from those funds (similar to a check). A credit card, on the other hand, does not draw any money immediately and must be paid back in the future, subject to any interest charges accrued. Whenever an accounting transaction is created, at least two accounts are always impacted, with a debit entry being recorded against one account and a credit entry being recorded against the other account.

The difference between the two is where the money to pay for the purchase comes from. If you have multiple credit cards, it’s not a bad idea to have a primary one you use for most purchases and save any others for emergencies or specific purchases. For example, a card that offers 1% cash back on all purchases makes for a good everyday card, while another that offers 2% back on gas purchases makes sense to use for that expense alone. As long as the customer reports the loss or theft in a timely manner, their maximum liability for purchases made after the card disappeared is $50.

And if you’re interested in applying, it might be worth checking to see if you’re pre-approved for any offers. At the end of each billing cycle—usually every 30 days or so—you’ll receive a credit card statement telling you how much you’ve spent, how much you owe and when your payment is due. By paying your credit card bill, you’re paying back the money you borrowed. While storing your credit information on a digital Using Debit and Credit wallet may sound like a fast track to getting hacked, virtual wallets actually make transactions safer. Today’s digital wallets use multiple forms of security to ensure that your credit card number remains hidden during every online shopping transaction. By creating a unique token every time you shop, for example, digital wallets make it very difficult for thieves to steal your credit card information.

But which type of plastic card should you use a debit card or a credit card? The company records that same amount again as a credit, or CR, in the revenue section. Also, you may want to consider using a debit card rather than a credit card when making an international purchase if you have a credit card that charges foreign transaction fees. Before you travel abroad, double check to see which fee is lower. “As much as I love credit card rewards, I wouldn’t want to pay a 3% fee just to get 1% or 2% cash back,” says Rossman.

A credit card can come in handy when you’re, say, booking a hotel room or rental car. In fact, some companies may not let you make a reservation without a credit card. This has to do with temporary transaction holds (see the debit card considerations

section above for more information). If you are allowed to book with a debit card, the company may instantly charge you for the full expense of the reservation. If you have not properly budgeted for that expense, it may be a burden on the available

balance in your checking or spending account. It can be easier and more strategic to use a credit card in those situations.